Learn about the Bar and Nightclub industry and find information on how to open a bar business or your own nightclub. Don’t forget you can receive free or low-cost training and free professional business advice, from your local Small Business Development Center!

View our related business reports here: Full Service Restaurant Business, Fast Food Restaurant Business and Beverage Industry Research.

Get a free Bar Business & Nightclub business plan template on our Business Plans page.

Bar & Nightclub Business Forecast

The impact of global pandemic on the hospitality industry as a whole has trickled into the different niches of the industry including bar and nightlife. The most prominent issues being: rising costs and prices, inflation and labor shortages. WSWA’s Sip Source end of year report for 2022 had the on-premise sales steadily recovering, however the analysts predicted that there will not be a complete recovery to pre-pandemic levels in 2023 due to effects of inflation.

According to The Spirits Business article inflation has prompted 26% of consumers to switch to buying beverages for at home consumption. Millennials being the more prominent demographic of home drinking, with 33% planning on consuming alcohol at home. There is a difference in inflation affecting women and men, according to the survey 60% of women and 50% of men stated that they changed the frequency of going out to bars and restaurants.

An article titled “Nightlife Inflation” discusses the rising prices of nightlife, stating that Gerber Group – which owns nightlife properties, increased employee pay by 25%. Labor shortages have been prominent since the pandemic with talent being laid off and finding opportunities in other industries. Currently the biggest challenge is training and retaining people. In Lightspeed article to deal with staffing shortages operators implemented improved technology and digitization. 46% of the operators implemented new management software and POS systems which helped them streamline and automate some of the processes like scheduling. Some other digital innovations that have increased efficiencies in the industry are QR codes and contactless payments.

According to Bar and Restaurant survey some of the trends to look out for are catering to health-conscious consumers by adding no-and low alcoholic drinks. Though traditional drinks are still popular with margaritas being the most popular cocktails making tequila and agave spirits among the top drink trends. Here are additional pandemic business resources specific to this industry:

- SBDCNet’s COVID-19 Small Business Resources

- SBDCNet’s COVID-19 Industry Resources

- Aid and Resources for Bartenders During the COVID-19 Bar Closures

- How Restaurant and Bar Workers Can Protect Themselves From Ongoing Health Risks

- Bar and Restaurant Revival Guide

Bar & Nightclub Business Overview & Trends

NAICS Code: 722410, SIC Code: 5813

Bars and Nightclubs are an important segment of the U.S. hospitality industry with a notable impact on the U.S. economy. Statista reports a 2021 industry revenue of approximately $247.3 billion dollar industry revenue across an estimated 67,000 locations.

The following Bar and Nightclub industry summary is from First Research which also sells a full version of this report.

- “Companies in this industry sell alcoholic beverages for on-premises consumption and may also offer limited food service. The industry mostly consists of small, single-location businesses, as inconsistent liquor laws make it harder to operate establishments in multiple states or countries. Some larger US-based bar chains include McMenamins, Winking Lizard Tavern, and World of Beer. Top-grossing nightclubs LAVO Nightclub, Marquee Nightclub, and Tao Downtown Nightclub each have locations in New York City and Las Vegas. Leading companies in the less-fragmented UK market include pub operators Punch Pubs & Co and Stonegate Group, as well as the nightclub chain REKOM UK.

- Bars and nightclubs market is forecast to reach over $30 billion at a compound annual growth rate (CAGR) of 5.09% between 2022 and 2027, according to Technavio. The increasing number of pubs and bars drives the market growth as the urban population worldwide has increased by more than 4% over the past ten years, according to the United Nations Conference on Trade and Development (UNCTAD).

- The US bar and nightclub industry includes about 40,000 establishments (single-location companies and units of multi-location companies) with combined annual revenue of about $24 billion.

- Competitive Landscape: Personal income and entertainment preferences drive demand. The profitability of individual companies depends on the ability to drive traffic and develop a loyal clientele.”

These Cafés/Bars market insights are from from Euromonitor which sells a full version of their report.

- Bars and Pubs in 2022 were the best performing category, with sales of $31.3 billion.

- Digitization:

- Increased digitization has been normalized by the pandemic and led to adoption of new tech by bars, restaurants, and cafe. Some of the new era technology that has been adopted include an increase of self-service payment systems. These customer-facing payment terminals have gained popularity and led to increase tipping by the clientele.

- Self-Service taprooms:

- An emerging trend among drinking establishments in the US. The opportunities with self-service taprooms are in the ability to reduce waste, clients can order by the ounce and try a variety of drinks, reducing wait times, customers don’t need to be served, frees up staff for other tasks, especially since labor shortages are a prominent issue that are anticipated to continue.

- Bars and taprooms can offer this unique experience and use it as an opportunity to grow.

Additional resources on the bar industry overview and trends:

- The Future of Hospitality in the U.S.

- Profitable Bar Industry Trends for 2023

- Current Trends & Traffic in the On-Premise

- 7 Alcohol Trends in 2022-23

- Top Bar Trends for 2023

Bar Business & Nightclub Customer Demographics

Major customer segments for bars and nightclubs are reported by IBISWorld, which offers a full version of the report for purchase here.

- The Bars & Nightclubs industry generates approximately $36.4 billion with households dominating at 91.9% of earned revenue.

- The major markets are segmented by age (from 25 to under to 65 and over).

- The age demographic breakdown is in the following order:

- Consumers in the age group of 21-34 comprise about 31.1% of industry revenue, making up the prime demographic. This age group tends to have more free time and less responsibilities than older age groups so they frequent bars the most.

- Consumers between the ages 35-65 make up about 47% of the market altogether. Though these consumers tend to drink less they have more disposable income. This demographic prefers the ambiance of the establishment rather than entertainment options available.

- People aged 65 and above make up 12.7% of the market, the attendance of nightlife business decreases due to health concerns.

- Private sector is the last category of consumers, typically businesses that rent out spaces for private events, they take up 8.1% of the market.

Additional information on bar and nightclub customers can be found in a variety of trade associations and publications, including:

- U.S. Alcohol Consumption on Low End of Recent Readings

- Low- and no-alcohol in high spirits as consumer trends continue to drive growth

- 2022 Alcohol Trends: What Consumers are Drinking Now

- What the Data Actually Says About Gen Z & Alcohol

- Alcoholic Beverage Consumption Statistics and Trends 2023

Bar Business & Nightclub Business Startup Costs

According to Investopedia, the average bar startup costs are as follows:

- “Total startup costs for a bar that rents or leases its location are estimated to be between $110,000 and $550,000, depending on size.”

Additional bar startup costs information can be found at:

- In a Toast Tab article the cost of opening a bar is – rented/Leased: $110,000-$550,000; Bought with a Mortgage: $175,000 – $850,000; Kitchen and Bar equipment: $30,000 – $150,000, with average of $115,655; Average Liquor Licenses: $1,406.98.

- Based on a survey of independent operators by Restaurant Owner costs are as follows – total: $425,000 with a cost per seat: $2,710; Construction: $250,000; Bar Equipment: $85,000.

- Estimated costs of opening a starting a sports bar according to Profitable Venture – total: $218,900; cost to rent/lease space: $80,000; Inventory: $15,000; Equipment costs: $22,970.

- Starting your Business approximates costs of starting a nightclub as – smaller establishment: $80,000; larger club: $400,000+.

Bar Business & Nightclub Business Plans

- Bar and Tavern Business Plan from The Finance Resource

- Bar Business Plan from Profitable Venture

- Foosball Hall and Bar Business Plan from Bplans

- Sports Bar Business Plan from Bplans

- Sports Bar Business Plan from The Finance Resource

- Bar Business Plan from Profitable Venture

- Nightclub Business Plan from The Finance Resource

- Nightclub Business Plan from Bplans

- Night Club & Bar Business Plan from Profitable Venture

Bar & Nightclub Business Associations

Trade associations often are excellent sources of information on an industry. Here are some relevant bar and nightclub industry associations:

- Distilled Spirits Council of the United States

- American Beverage Licensees

- American Nightlife Association

- Beverage Tasting Institute

- The Food and Beverage Association of America

- National Alcohol Beverage Control Association

Bar Business Regulations

The section provides a general awareness of regulations and agencies to consider when starting a bar business. Check with your state and municipality for rules and regulations that may impact the business in your area. Most alcoholic beverage business regulations come from the state level, but local zoning ordinances or policies may further regulate your operations.

- TTB Alcohol Beverage Regulations – federal resources (laws/regulations, permits, labeling & more) for the beverage alcohol industries from the Alcohol and Tobacco Tax and Trade Bureau

- State Law Database – wine, beer, and distilled spirits laws and regulations by state, issue or a combination of the two (membership required)

- The Laws & Regulations About Alcohol

- State Profiles of Underage Drinking Laws

- Wages and the Fair Labor Standards Act

- Minimum Wages for Tipped Employees

For more information on employment issues visit our Human Resources for Small Business

Bar Business Publications

Bar & Nightclub Business Employment Trends

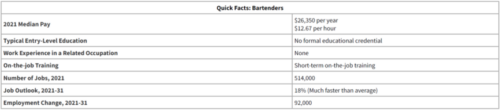

Labor costs are important factors for bar & nightclub business owners. Here is a Bar & Nightclub Business labor market summary from the Bureau of Labor Statistics focused on Bartender Job Market Conditions.

- “Pay: The median hourly wage for bartenders was $12.67 in May 2021.

- Work Environment: Bartenders work at restaurants, hotels, and other food service and drinking establishments. During busy hours, they are under pressure to serve customers quickly and efficiently. They often work late evenings, on weekends, and on holidays. Part-time work is common, and schedules may vary.

- Job Outlook: Employment of bartenders is projected to grow 18 percent from 2021 to 2031, much faster than the average for all occupations. About 105,300 openings for bartenders are projected each year, on average, over the decade. Many of those openings are expected to result from the need to replace workers who transfer to different occupations or exit the labor force, such as to retire.”

A more specific breakdown of wages for Accommodation and Food Services businesses in the US can be found here (see 35-3011 & 35-9011).”

Additional Small Business Resources

Already in business or thinking about starting your own small business? Check out our various small business resources:

- View more business reports here: Small Business Snapshots

- View small business help topics here: Small Business Information Center

- View industry-specific research here: Market Research Links

- View business plans samples here: Sample Business Plans

Remember, you can also receive free professional business advice and free or low-cost business training from your local Small Business Development Center!

Photo credit: Photo by Luca Bravo on Unsplash