Learn about the restaurant industry and find information on how to start a restaurant business. Don’t forget you can receive free or low-cost training and free professional business advice, from your local Small Business Development Center!

View our related business reports here: Fast Food Restaurant Business, Food Truck Business, Bar Business, and Food Service Industry Research.

Get a free Restaurant Business plan template on our Business Plans page.

Restaurant Business Forecast

The full-service restaurant industry has been recovering from the pandemic as demand for dining out has steadily increased heading in to 2024. Demand has continued to outpace the ability of restaurants to properly respond due to labor shortages in the industry; a shortage of 500,000 employees in the industry has forced operators to pursue strategies to operate with a labor deficit. Some of them implemented pay raises, some decreased operation hours and many others have increased digitization. According to a Toast Survey, 1 in 3 restaurants reported having a hard time attracting new labor, while 8% laid off staff due to economic constraints. While staffing may be an ongoing challenge, a report from National Restaurant Association’s chief economist indicates positive workforce developments returning to pre-pandemic levels.

Restaurants have increased their menu prices in an effort to deal with these local issues among global challenges as well. Supply chain issues that resulted from the pandemic persisted and intensified due to climate change and geopolitical situations in the world. An FSR Magazine report points to extreme drought conditions in the West and flooding in the Midwest as impacting crop farming efforts in their respective regions. Ongoing geopolitical conflicts have further strained supply chain issues, with low trade volume and maritime transportation logistics. For reference, according to a McKinsey & Company report, Ukraine and Russia collectively produced about 28% of wheat and 15% of corn global exports.

According to Nation’s Restaurant News, prices at full-service and limited services restaurants increased by 8.8% and 7.1% accordingly due to rising ingredient costs. The increased menu prices are prompting consumers to switch to more cost-effective food options and seek discounts. Another report from Nation’s Restaurant News identifies the impact of inflation on consumer behaviors with full-service traffic dropping by 1% while visits increasing 4% when a deal was offered.

Here are additional pandemic business resources specific to this industry:

- SBDCNet’s COVID-19 Small Business Resources

- SBDCNet’s COVID-19 Industry Resources

- Best Practices for Establishments during the COVID-19 Pandemic – U.S. Food & Drug Administration

- COVID-19 Resources, including reopening guide – National Restaurant Association

- A Playbook for Reopening Your Restaurant – QSR Magazine

- Franchise Reopening Blueprint, including Restaurants – International Franchise Association

Full-Service Restaurant Business Overview & Trends

NAICS Code: 722511, SIC Code: 5812

Restaurants are an important segment of the U.S. food services industry with a phenomenal impact on the U.S. economy. The National Restaurant Association State of the Industry Report projects $997 billion in industry sales.

This restaurant industry summary is from First Research which also sells a full version of this report.

- “Companies in this industry operate restaurants and other eating places, including full-service restaurants (FSRs), quick-service restaurants (QSRs), cafeterias and buffets, and snack bars. Major companies include Bloomin’ Brands, Darden Restaurants, McDonald’s, Starbucks, and Yum! Brands (all based in the US), as well as Greggs (the UK), Jollibee (the Philippines), Skylark Group (Japan), and Restaurant Brands International (Canada).

- The global food service industry generates about $2.5 trillion in 2021 and is forecast to grow to $4.4 trillion in 2028 at a 9.9% compound annual growth rate (CAGR) from the 2021 to 2028 forecast period, according to Statista. Cross-border franchising of restaurants has helped boost growth in recent years. The largest restaurant markets by country in 2022 are China, India, and Japan, according to Statista.

- The US restaurant industry includes about 570,000 restaurants with combined annual revenue of about $600 billion.

- Competitive Landscape: Restaurants are adopting new technologies and services to compete for consumers who increasingly value convenience. Mobile payments, online ordering, and home delivery are becoming more commonplace in both the full-service and limited-service segments of the industry. Pricing is also becoming a more important issue as customers are able to choose from a growing variety of dining options, including pre-packaged meals from outlets such as grocery stores, convenience stores, and coffee shops. Emerging competitors such as providers of subscription meal kits could further disrupt the industry in the future.”

These restaurant and consumer foodservice business market insights are derived from Euromonitor which sells a full version of their report.

- Economic Developments:

- In 2022 the US economy has been hit by inflation causing increase in costs for all industries. Even with increase in menu prices full-service restaurants faced shrinking margins. The price increase has hit the grocery category stronger keeping restaurants a feasible dining option. Due to Federal Reserve raising interest rates in order to slow down the inflation rates the outlook on 2023 is brighter.

- The increase in interest rates decreased the amount of capital available for business owners, especially small business owner who have smaller credit lines. Lack of easily available funds put plans for expansion into jeopardy.

- Labor has become a central issue, the industry has been concerned with staffing shortages, salary and benefits for employees. Due to low pay and lack of benefits employees sought employment elsewhere leaving the industry understaffed. The issue did not get any resolutions in 2022 staying an issue that each operator deals with themselves.

- Restaurant Operations:

- With the onset of pandemic food habits of consumers have changed with a switch to delivery services. Many restaurants started partnering with third-party services to be able to offer their food with convenience. The switch to convenience meant a lot of restaurants needed to improve their technological output by creating websites and apps for ease of ordering. However, with safety concerns easing in 2023 people are going back to dining-in making the delivery option less appealing. Another reason for less interest in deliveries are the rising costs due to inflation. Gas prices are an additional factor increasing delivery pricing. Making operators weigh pros and cons of keeping delivery as part of their operating model.

- With move to remote work foot traffic around business centers has decreased, leading to a decrease in visits to restaurants in those area. Though some companies have gotten back to face to face operations, restaurants will need to consider the location in order to best meet consumer demand.

- Pandemic shut downs caused a rise in virtual brands, restaurants without a physical location. With restaurants being open again the virtual brands stand at a crossroads. Big brand names will have a higher chance of surviving, but the newcomers and small businesses will be met with challenges. Success can be found in niche offerings with a great focus on marketing to achieve stability.

Restaurant Customer Demographics

Major customer segments for full service restaurants and chain restaurants are reported by IBISWorld, which offers full versions of the reports for purchase here and here.

- Both the chain restaurant and single location restaurant markets are segmented by age, income, and household characteristics.

- Highest income, $100,000 and up, consumers are the biggest spenders for both single and chain restaurants. In both categories they contribute to 50% of the establishments’ income.

- The market is benefiting from older adults as they have higher disposable income which gives them the opportunity to take out their families for dinners. Another prominent group is young adults delaying marriage and start of family therefore having more disposable income.

- With unemployment and popularity of eating at home during quarantine the spending in middle-income, $30,000-$99, 999, category decreased.

- Re-opening prompted a return to eating out by middle-income households, generating steady demand.

Additional information on restaurant customers can be found in a variety of trade associations and publications, including:

- Toast Consumer Statistics – restaurant industry statistics for 2023

- Consumer Behavior in Post-Pandemic World – The shifts in demographics and preferences of consumers

- The Changing Consumer – effects of inflation on consumer purchasing behaviors

Restaurant Business Startup Costs

According to a survey conducted by RestaurantOwner.com, the average restaurant startup costs are as follow:

- “Overall Costs: $375,500 – total, $3,586 – cost per seat, $113 – cost per sq. ft.

- Full Service Costs: $475,500 – total, $3,248 – cost per seat, $111 – cost per sq. ft.”

Additional restaurant startup costs information can be found at:

- Cost to Open a Restaurant from Toast

Costs of opening a restaurant vary depending on rent, furnishing of the restaurant, renovation needs and can range $95,000 to over $2 million. - Cost to Start a Restaurant from WebstaurantStore

Restaurant startup costs range from $180,000 to $800,000 depending on the location, concept, choice of buying vs leasing the space. - Navigating Restaurant Cost Control from Lightspeed

Tips on managing costs - The Essential Restaurant Equipment Checklist from Square

Checklist of equipment needed to open a restaurant

Restaurant Business Plans

The following are sample Restaurant Business Plans for reference. For additional business plan samples, visit our Business Plans guide.

- Fine Dining Restaurant Business Plan – BPlans

- Restaurant Business Plan – The Finance Resource

- Restaurant Business Plan – Profitable Venture

- Restaurant Business Plan – Restaurant Owner

- How to Write a Restaurant Business Plan – OpenTable

Restaurant Business Associations

Trade associations often are excellent sources of information on an industry. Here are some relevant restaurant industry associations:

- National Restaurant Association

- State Restaurant Associations – select state from drop down

- Green Restaurant Association

- Council of State Restaurant Associations

Restaurant Business Regulations

The section is intended to provide a general awareness of restaurant regulations and agencies to consider when starting a restaurant business. Check with your state and municipality for rules and regulations that may impact the business in your area.

- State Retail and Food Service Codes and Regulations by State – U.S. Food & Drug Administration

- Food Code – U.S. Food & Drug Administration’s model for best practices for food safety

- Tips & Wages – Resources on Tips from US Department of Labor

- Alcohol Laws by State – Federal Trade Commission

Restaurant Publications

- Nation’s Restaurant News

- Restaurant Business

- Modern Restaurant Management

- Restaurant Startup & Growth

- Food Network Magazine

- Food and Wine Magazine

Restaurant Business Employment Trends

The National Restaurant Association Facts at a Glance reports on the size of the restaurant workforce:

- “2023 Employment Forecast: 500,000 new jobs for total foodservice employment of 15.5 million

- 9 in 10 restaurants have fewer than 50 employees

- Waitstaff at fullservice restaurants earn a median of $27.00 an hour, with an upper quartile of $41.50 and a lower quartile of $19.00″

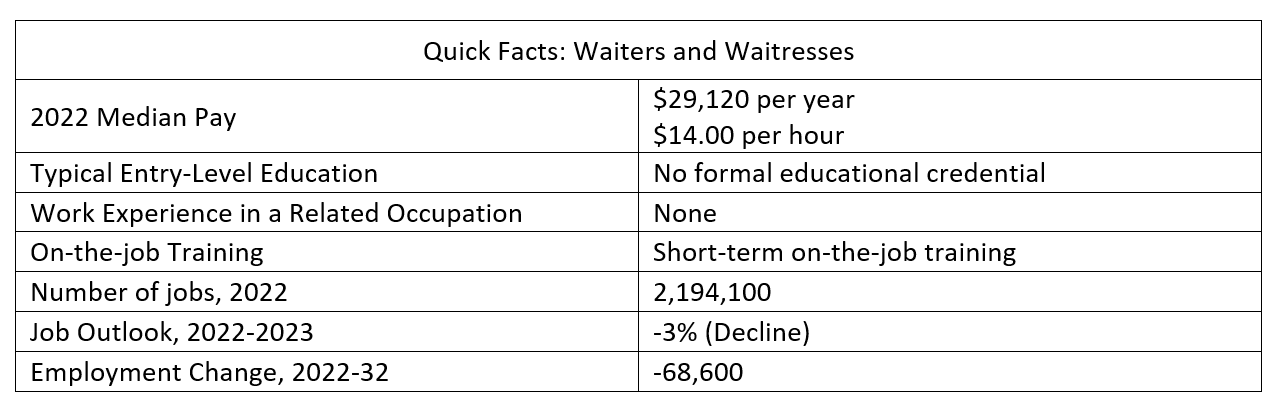

Labor costs are important factors for full service restaurant owners. Restaurants encompass a variety of jobs, the following are insights from the Bureau of Labor Statistics into the most customer-facing employees in restaurants, waiters and waitresses. A more specific breakdown of other full-service restaurant occupations is available from the Bureau of Labor Statistics.

- “The median hourly wage for waiters and waitresses was $14.00 in May 2022.

- Work Environment: Waiters and waitresses work in restaurants, bars, hotels, and other food-serving and drinking establishments. Part-time work is common, and schedules may vary to include early mornings, late evenings, weekends, and holidays.

- Job Outlook: Employment of waiters and waitresses is projected to decline 3 percent from 2022 to 2032.

Despite declining employment, about 440,000 openings for waiters and waitresses are projected each year, on average, over the decade. All of those openings are expected to result from the need to replace workers who transfer to other occupations or exit the labor force, such as to retire.”

Additional Resources

Already in business or thinking about starting your own small business? Check out our various small business resources:

- View more business reports here: Small Business Snapshots

- View small business help topics here: Small Business Information Center

- View industry-specific research here: Market Research Links

- View our small business cybersecurity resources here: Cybersecurity

- View our pandemic business resources here: COVID-19 Publications

Remember, you can also receive free professional business advice and free or low-cost business training from your local Small Business Development Center!

Photo by Fabrizio Magoni on Unsplash