Learn about the Assisted Living Industry and find information on how to start your own Assisted Living Facility. Don’t forget you can receive free or low-cost training and free professional business advice, from your local Small Business Development Center!

View our related business reports here: Home Health Care Services Business and Medical Practice Business.

Get an Assisted Living Facility business plan template on our Business Plans page.

Assisted Living Facility Business Forecast

The assisted living facility industry is poised for significant growth, driven by rising healthcare needs and shifting demographics. The number of Americans aged 65 and older continues to climb, creating a growing demand for long-term assisted living as the population gap between children and older adults narrows. A recent U.S. Census report shows an increasing number of states and counties where older adults outnumber children, highlighting the need for more senior living communities. This demand is further fueled by rising life expectancy, projected to increase from 19.6 to 21.8 years for individuals aged 65 and older in the U.S. Longer lifespans bring more complex healthcare needs, particularly in managing chronic conditions like diabetes, heart disease, and arthritis. These trends present a clear opportunity for assisted living communities to expand their services and develop specialized care solutions to meet the evolving needs of an aging population.

While demand is trending upward, supply has struggled to keep pace due to high development costs and complex regulations. Ongoing changes in Medicaid, Medicare, and varying State legislation will also require close monitoring and strategic planning. Looking ahead, assisted living communities will need to expand and specialize in order to meet these growing demands, and respond to industry challenges. Facilities may need to develop tailored care models that integrate medical support, and daily living assistance. As these care models evolve, emerging technology will play a greater role in shaping future operations. From wearable health-monitoring devices to smart facility management systems, tech driven tools are becoming an essential part of daily life in assisted living communities. Providers must embrace innovation, respond to changing healthcare needs, and navigate a complex regulatory landscape to meet the demands of a rapidly aging population.

Here are some additional business resources specific to the industry:

- American Health Care Association & National Center for Assisted Living – Provider Resources

- American Senior Housing Association – Research & Analytics

- National Investment Center for Senior Living – Research Resources

Assisted Living Business Overview & Trends

NAICS Code: 623312; SIC Code: 8361

Assisted living facilities are an important contributor to the senior care industry. The National Center for Assisted Living reports that there are approximately 30,600 assisted living facilities in the U.S., a number that will need to increase to handle the estimated 82 million people that will comprise that age group by 2050.

This continuing care & assisted living facilities summary is from First Research which also sells a full version of this report.

- “Companies in this industry provide residential and personal care services for the elderly and others who need or want assistance. Major companies include Brookdale Senior Living, Five Star Senior Living, and Sunrise Senior Living (all based in the US), as well as Housing 21 (UK), Sienna Senior Living (Canada), and Tertianum (Switzerland).

- In 2024, there were about 860 million people aged 65 years or over worldwide, according to the United Nations Population Division. Asia is at the forefront of this trend, with Hong Kong, South Korea, Taiwan and Japan expected to have the highest share of people aged 65 and older by 2050, according to Statista.

- The US continuing care and assisted living facilities industry includes about 25,000 establishments (single-location companies and branches of multi-location companies) with combined annual revenue of $65 billion. Companies that provide residential skilled nursing services are covered in a separate profile.

- Competitive Landscape: Demand for continuing care is strong due to rapidly aging senior populations in the US and other developed nations. The profitability of individual facilities depends on efficient operations and positive relations with payers, including families and government and commercial insurers. Large companies have some economies of scale in administration and purchasing. Small operators can compete effectively by offering quality service. Small operators can compete effectively by offering quality service and attractive amenities, or by operating in a prime location. The US industry is fragmented: the 50 largest companies account for about 30% of revenue.”

Assisted Living Facility Technology

Technology is an increasingly vital component of the senior care industry. Tools such as telehealth services, companion tech, and integrated health record systems are being actively adopted across assisted living facilities. These innovations not only enhance resident safety but also support more flexible, efficient, and person-centered care. Here is information on technology usage in assisted living facilities:

- Accelerating Innovation in Senior Living – explores IT infrastructure and adopting emerging technologies.

- American Retirement Homes – utilizing tech solutions to improve senior life and reduce costs.

- Unlocking innovation – assess key barriers and ways to fill technological gaps for senior care.

- Elder Care Alliance – examines how tech has transformed long-term care.

For additional information on technology, visit our AI for Small Business Guide.

Assisted Living Facility Customer Demographics

Major customer segments for Assisted Living Facilities are reported by IBISWorld which offers a full version of this report for purchase here.

- The Assisted Living Facility is segmented by funding availability, including out-of-pocket payments, Government-funded Insurance, such as Medicaid and Medicare, and Private Insurance.

- Out-of-pocket payments accounts for 47.1% of the market and pertains to private funds from lifelong accumulation of assets, home sale, or financial assistance from family members.

- Increases in per capita disposable income increase the ability for people to pay out-of-pocket facility expenses.

- Retirement communities also generate non–patient care revenue. Contributions from foundations and nonprofit organizations, along with fundraising efforts and donations from residents’ families, account for approximately 33% of the industry’s total funding.

- Many seniors rely on government-funded insurance programs, which accounts for 14% of the market. Some facilities are reluctant to accept Medicaid as a form of insurance because of low reimbursement rates.

- Some residents supplement out-of-pocket with private insurance options, which makes up the final 5.9% of the market.

Additional information on assisted living demographics can be found in a variety of trade associations and publications, including:

- American Health Care Association & National Center for Assisted Living – Residential Characteristics

- American Psychological Association – Older Adults Health & age-related changes

- National Council on Aging – Older adult demographics

Assisted Living Facility Startup Costs

Establishing an assisted living facility requires an understanding of the startup costs involved in order to develop a sound financial plan. Whether you’re purchasing an existing facility or selecting a site to build your own, there are many important costs to consider.

According to a cost breakdown reported by Profitable Venture, assisted living facilities related costs are as follows:

- “Estimate minimum startup costs of $487,380 to set up a medium-scale assisted living facility.”

Additional assisted living facility startup cost information can be found at:

- Assisted living startup costs – Growthink

- “An assisted living facility must be equipped with medical and safety equipment to ensure the well-being of its residents. This includes items like medical beds, emergency call systems, first aid kits, and defibrillators. Plan to invest around $100,000 to $300,000 in medical and safety equipment.”

- How to start an assisted living business from Small Business Chron

- “Obtain an operator’s license required by your state. Decide if you will structure your assisted living business as an LLC, corporation, partnership or sole proprietor before applying for a state license. A qualified CPA or business attorney is best to advise which structure will provide the best tax advantages for your new business.”

Assisted Living Facility Business Plans

The following are sample assisted living facility business plans for reference. For additional business plan samples, visit our Business Plans Guide.

- Residential Assisted Living Business Plan – Profitable Venture

- How to Write an Assisted Living Business Plan – Bplans

- Assisted Living Facility Business Plan – Growthink

- Nursing Home Business Plan – Profitable Venture

Assisted Living Business Associations

Trade associations often are excellent sources of information on an industry. Here are some relevant assisted living industry associations:

- National Center for Assisted Living

- Assisted Living Federation of America

- American Seniors Housing Association

- The Consumer Consortium on Advanced Person-Centered Living

- Center for Excellence in Assisted Living

- Aging Life Care Association

- Elder Care Workforce Alliance

Assisted Living Facility Business Regulations

The section is intended to provide a general awareness of assisted living facility regulations and agencies to consider when starting your business. Check with your state and municipality for rules and regulations that may impact the business in your area.

Assisted living facilities are primarily regulated at the state level. According to the National Center for Assisted Living’s State Regulatory Review, 44 states (86%) have established infection control requirements. Their report also includes state-by-state legislative and regulatory updates.

- U.S. Centers for Medicare & Medicaid Services – Regulations & Guidance

- U.S. Department of Housing and Urban Development – Assisted-Living Conversion Program (ALCP)

- Occupational Safety and Health Administration – Hazards and Solutions

Assisted Living Business Publications & Resources

- Residential Assisted Living National Association

- Senior Living Executive Magazine

- Senior Housing News

- McKnight’s Senior Living

- Provider Magazine

- Environments for Aging

- Senior Living News

For resources to help market your assisted living start up, visit our Digital Marketing Guide, Social Media Marketing Guide, and our Website Design Guide.

Assisted Living Facility Employment Trends

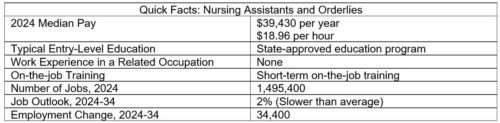

Understanding employment trends in your industry is important when opening an assisted living facility. Assisted living facilities rely on a range of roles to operate effectively. Depending on the services offered, this could include housekeeping, medical care, dining staff, and personal care aides. The following are insights from the Bureau of Labor Statistics Occupational Outlook Handbook into Nursing Assistants and Orderlies. A more specific breakdown of other assisted living occupations is available from the Bureau of Labor Statistics.

- “Pay: The median annual wage for nursing assistants was $39,530 in May 2024. The median wage is the wage at which half the workers in an occupation earned more than that amount, and half earned less. The lowest 10 percent earned less than $31,390, and the highest 10 percent earned more than $50,140.

- Work Environment: The work of nursing assistants and orderlies may be strenuous. They spend much of their time on their feet as they care for patients.

- Job Outlook: Overall employment of nursing assistants and orderlies is projected to grow 2 percent from 2024 to 2034, slower than the average for all occupations. Despite limited employment growth, about 211,800 openings for nursing assistants and orderlies are projected each year, on average, over the decade. Most of those openings are expected to result from the need to replace workers who transfer to different occupations or exit the labor force, such as to retire.”

Additional Small Business Resources

Already in business or thinking about starting your own small business? Check out our various small business resources:

- View more business reports here: Small Business Snapshots

- View small business help topics here: Small Business Information Center

- View industry-specific research here: Market Research Links

- View business plans samples here: Sample Business Plans

Remember, you can also receive free professional business advice and free or low-cost business training from your local Small Business Development Center!

Photo by Dominik Lange on Unsplash