Learn about the Medical Practice Industry and find more information on how to start your own Medical Practice. Don’t forget you can receive free or low-cost training and free professional business advice, from your local Small Business Development Center!

View our related business reports here: Home Health Care Services Business and Assisted Living Facility Business

Medical Practice Business Forecast

The medical practice industry remains a strong component of the healthcare system, serving as the primary point of contact for most patients and delivering essential outpatient and specialty care. As the U.S. population grows and the life expectancy rises, demand for physicians and medical services is expected to increase in the coming years. However, despite this growing need, the projected demand for physicians is anticipated to exceed supply, leading to an estimated shortage of 13,500 and 86,000 physicians by 2036. This imbalance is largely attributed to the aging physician workforce. According to The Association of American Medical Colleges, 23.4% of active physicians are age 65 or older, which may accelerate retirement rates. Therefore, a proactive approach will be needed for practices to address the anticipated staff shortages.

The medical practice sector will continue to advance as digital transformation accelerates across the industry. Many small and mid-sized practices are increasingly leveraging technology to streamline administrative tasks and improve operational efficiency. At the same time, the ongoing acquisition of independent practices by hospitals and corporate entities has reshaped ownership structures. This may create new opportunities for resource sharing while also challenging traditional physician business models. Despite these shifts, small business practices retain key advantages with building patient relationships and local community presence. Looking ahead, investment in digital tools, operational innovation, and maintaining a patient-centered focus will be important for operating a medical practice.

Here are some additional business resources specific to the industry:

- American Medical Association – Practice Management Resources

- American Academy of Family Physicians – New Physician Resources

- HCA Healthcare – Physician Resource Center

Primary Care Physicians Business Overview & Trends

NAICS Code: 621111; SIC Code: 8011 & 8031

Medical groups have experienced sustained economic growth and low unemployment, as they have become key contributors to the healthcare system. Last year, the national unemployment rate remained steady at 4.1%, with healthcare continuing to be a leading sector for job growth.

This physicians summary is from First Research, which also sells a full version of this report.

- “Offices in this industry provide general or specialized medical care. No major companies dominate.

- Globally, there are about 170,000 medical doctors in 2022, according to the World Health Organization (WHO). By 2030, it is estimated that there would be a shortage of health workers, including physicians, which would affect the quality of the health systems.

- The US physician’s industry includes about 223,000 offices with combined annual revenue of about $475 billion.

- Competitive Landscape: Physicians are under pressure from government payers and insurers to lower costs while improving quality of care. The profitability of individual practices depends on the reputation, cost, operational efficiencies, and expertise of the physician and staff. Large practices have advantages in leveraging administrative processes and expensive diagnostic equipment. Small practices compete effectively by providing specialized skills and good customer service. Population growth, injury and illness rates, and demographics play a role in demand for services. Physicians practicing in urban areas generally have several direct competitors in the immediate geographic area, while access to care may be restricted in rural communities.

- The US industry is highly fragmented: the top 50 firms account for about 20% of industry revenue. As reimbursements shift toward pay-for-performance protocols, more physicians are responding by joining group practices or health care networks.”

Medical Practice Technology

Technology plays a critical role in the medical practice industry. Advanced diagnostic tools and data analytics allow providers to detect conditions earlier and further personalize treatments. The American Medical Association reported 66% of physicians utilizing AI for documentation of billing codes, visit notes, and more. Here is information on technology usage in the medical practice industry:

- Health Care Technology Trends – American Medical Association

- Empowering Healthcare Providers Through Technology – impact of tech solutions.

- Essential Software – benefits of utilizing medical software.

- Emerging Technologies in Healthcare – the future of medical office software.

- Tech Trends – AI adoption in the healthcare industry.

For additional information on technology, visit our AI for Small Business Guide.

Primary Care Doctors Customer Demographics

Major customer segments for Primary Care Doctors in the US are reported by IBISWorld, which offers full versions of the report for purchase here.

- The Primary Care Doctors market is segmented by age group.

- Children and Teenagers under 18 make up 10.8% of the market. This group provides consistent demand for pediatricians as schools mandate that students get routine care and screenings.

- The primary source of funding for this industry comes from adults aged 45 to 64, who make up 29.2% of the market, and use private health insurance.

- Adults between the ages of 18 and 44 make up 25.5% of the market, while adults aged 65 to 84 make up 29.9% of the market share. Both primarily use Medicare to cover medical expenses.

- Individuals aged 65 and older usually require frequent medical care due to age-related health issues. Patients aged 85 and over make up the remaining 4.6% of the market share, and they often require specialized care.

- As the number of adults aged 65 and older increases, medical practices have seen continuous growth in this sector, providing tailored services to older patients’ unique needs.

Additional information on medical practice demographics can be found in a variety of trade associations and publications, including:

- U.S. Centers for Disease Control & Prevention – physician patient demographics

- U.S. Census Bureau – health data

- American Medical Association – trends in health care spending

Medical Practice Startup Costs

Establishing a medical practice requires an understanding of the startup costs involved in order to develop a sound financial plan. Whether you’re purchasing an existing facility or selecting a site to house your practice, there are many important costs to consider.

According to a cost breakdown by Business News Daily, private medical practice related cost are as follows:

- “The actual dollar amount needed depends on your unique situation, but in general, you should aim to secure at least $100,000 to cover equipment and startup costs.”

Additional medical practice startup cost information can be found at:

- Cost to open a Medical Practice from Physician Practice Specialists

- “Office Space- $2500-$3400 per month.

- Payroll- $4800 per month.

- Vendors- Phone, utilities, biohazard etc. $5000 initial setup- $950 monthly.

- Equipment- $10000-$15000 for initial purchases. Make sure you can get what you need as supply constraints have hurt the availability of some equipment.

- Insurance- $1000 per year for GL, $5,000-$15,000 on average for malpractice. 1st year providers will pay a lot less since you won’t have a claims history.

- Logo, Website & Marketing- $6000-$7500 for the initial logo and website fees, $75-100 per month for maintenance, security and support and another $2500 towards digital marketing.

- Legal & Accounting- $1500 initial company formation and $250-$500 monthly bookkeeping/accounting (optional).

- Total Cost: $35000-$45000 initially with approximately $9000 per month.”

Medical Practice Business Plans

The following are sample medical practice business plans for reference. For additional business plan samples, visit our Business Plans Guide.

- Medical Clinic and Practice Business Plan – Profitable Venture

- Medical Practice Business Plan – Growthink

- Direct Primary Care Business Plan – Profitable Venture

- Family Medicine Clinic Business Plan – LivePlan

Medical Associations

Trade associations often are excellent sources of information on an industry. Here are some relevant medical industry associations:

- American Medical Association

- American Academy of Family Physicians

- World Health Organization

- American Association for Physician Leadership

- Association of American Physicians

- American Independent Medical Practice Association

- Medical Group Management Association

- Directory of Primary Care Associations and Health Centers

Medical Practice Business Regulations

This section is intended to provide a general awareness of medical practice and primary care industry regulations and agencies to consider when starting your business. Check with your state and municipality for rules and regulations that may impact the business in your area.

- U.S. Department of Health and Human Services – HIPAA Privacy Rule

- HHS Office of Inspector General – Compliance Programs for Physicians

- Centers for Medicare & Medicaid Services – Certification & Compliance

Medical Practice Publications & Resources

- Physician’s Weekly

- Physicians Practice

- Modern Healthcare

- Physicians News Digest

- News from American Association for Physician Leadership

- Practical Tools for Primary Care Practice

- Biomed Central Primary Care

- Journal of The American Board of Family Medicine Publications

For resources to help market your medical practice start up, visit our Digital Marketing Guide, Social Media Marketing Guide, and our Website Design Guide.

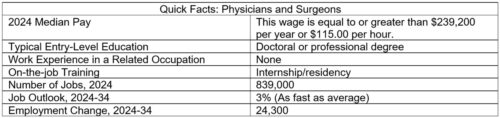

Physicians & Surgeons Employment Trends

Understanding trends in your industry is important when opening a medical practice. A critical component as a medical practice grows is hiring qualified help. The following are insights from the Bureau of Labor Statistics Occupational Outlook Handbook into Physicians & Surgeons. A more specific breakdown of other medical practice occupations is available from the Bureau of Labor Statistics.

- “Pay: Wages for physicians and surgeons are among the highest of all occupations, with a median wage equal to or greater than $239,200 per year. Most physicians and surgeons work full time. Some work more than 40 hours per week. Many physicians and surgeons work long shifts, which may include irregular and overnight hours or being on call. Physicians and surgeons may travel between their offices and the hospital to care for patients. While on call, a physician may need to address a patient’s concerns over the phone or make an emergency visit to another location, such as a nursing home.

- Work Environment: Physicians and surgeons work in both clinical and nonclinical settings. Some examples of clinical settings are physicians’ offices and hospitals, including academic hospitals associated with residency programs or schools of medicine. Nonclinical settings include government agencies, nonprofit organizations, and insurance companies. In clinical settings, physicians may work as part of a group practice or healthcare organization. These arrangements allow them to coordinate patient care but give them less independence than solo practitioners have.

- Job Outlook: Overall employment of physicians and surgeons is projected to grow 3 percent from 2024 to 2034, about as fast as the average for all occupations. About 23,600 openings for physicians and surgeons are projected each year, on average, over the decade. Many of those openings are expected to result from the need to replace workers who transfer to different occupations or exit the labor force, such as to retire. Growing demand for psychiatric care and improved access to mental health services will support job growth for psychiatrists. Meanwhile, the expected decline in the child population may constrain demand for pediatricians and pediatric surgeons.”

Additional Small Business Resources

Already in business or thinking about starting your own small business? Check out our various small business resources:

- View more business reports here: Small Business Snapshots

- View small business help topics here: Small Business Information Center

- View industry-specific research here: Market Research Links

- View business plans samples here: Sample Business Plans

Remember, you can also receive free professional business advice and free or low-cost business training from your local Small Business Development Center!

Photo by Hush Naidoo on Unsplash