Learn about the Fast food restaurant business and find information on how to open your own Fast Food restaurant. Don’t forget you can receive free or low-cost training and free professional business advice, from your local Small Business Development Center!

View our related business reports here: Full Service Restaurant Business, Food Truck Business and Bar Business, and Food Service Industry Research.

Get a free Fast Food Business plan template on our Business Plans page.

Fast Food Restaurant Business Forecast

The food service industry experienced major shifts and changes in response to the pandemic. Some of the greatest issues that impacted the fast food restaurant business included labor shortages, inflation, and pivot to online services.

While the restaurant industry as a whole experienced staffing shortage during the pandemic, fast food restaurants were more responsive in adapting their operations to pandemic safety guidelines. Given their adaptability, this segment of the industry did not experience as severe a job loss as the full-service segment. As of November 2023, the National Restaurant Association reports that staffing levels for fast food restaurants was 3% above pre-pandemic levels.

Despite easing of inflation, Specialty Food Association reports a 6.2% rise in prices for 2023 at fast food restaurants causing low-income consumers to look for other dining options. Notably, groceries appear to be less impacted by inflation with their prices rising slower than those at restaurants. The rising menu prices at restaurants are attributed to inflation which impacts costs like food, labor and operations.

The pandemic resulted in the inability for diners to eat at restaurants and was addressed by pivoting to online ordering, curbside pick-up, and delivery services. Though face-to-face operations have resumed, customers are still heavily utilizing online ordering. Insights from a Deloitte survey indicate that 40% of customers prefer ordering delivery and takeout via a restaurant’s app or website. Technology will continue to play a critical role in fast food restaurants, QSR reports that by 2025 fast food restaurant will automate 51% of tasks compared to 27% at their full-service counterparts. With 64% of customers making a purchase for a virtual good or in a virtual environment, and fast food restaurants testing the technology, the industry also should prepare for integration of ordering methods within the metaverse.

Here are additional pandemic resources specific to the industry:

- SBDCNet’s COVID-19 Small Business Resources

- SBDCNet’s COVID-19 Industry Resources

- Best Practices for Establishments during the COVID-19 Pandemic – U.S. Food & Drug Administration

- COVID-19 Resources, including reopening guide – National Restaurant Association

- A Playbook for Reopening Your Restaurant – QSR Magazine

- Franchise Reopening Blueprint, including Restaurants – International Franchise Association

Fast Food Restaurant Business Overview & Trends

NAICS Code: 722513, SIC Code: 5812

Fast food restaurants are an important segment of the U.S. food services industry with a notable impact on the U.S. economy. For 2023, the National Restaurant Association State of the Industry Report projects $997 billion in industry sales.

The following Fast food and quick service restaurant industry summary report is from First Research which also sells a full version of this report.

- “Companies in this industry operate restaurants in which customers order and pay at a counter. Major companies include Chipotle, McDonald’s, Wendy’s, and Yum Brands (all based in the US), as well as Café de Coral (Hong Kong), Greggs (UK), Restaurant Brands International (Canada), and Seven & i Food Systems (Japan).

The global fast-food market is forecast to reach about $1.5 trillion by 2028 at a CAGR of 6% during the 2021-2028 period, according to Fortune Business Insights. Consumer food service sales are expected to grow most rapidly in Latin America, the Middle East/Africa region, and the Asia/Pacific region.

The US fast-food and quick-service restaurant industry includes about 250,000 establishments with combined annual revenue of about $255 billion. Full-service restaurants and specialty eateries such as coffee shops are covered in separate industry profiles. - Competitive Landscape: Demand is driven by consumer tastes and personal income. The profitability of individual companies depends on efficient operations and effective marketing. Large companies have advantages in purchasing, finance, and marketing. Small companies can compete effectively by offering superior food or service. The US industry is highly fragmented: the 50 largest companies account for about 20% of revenue.

- Products, Operations & Technology: Major products of limited-service restaurants include meals and snacks prepared for on-premise consumption (30% of industry revenue), drive-through service (30%), off-premise meals (20%), prepared and served meals (5%), and nonalcoholic beverages (5%).”

This Limited Food service business market research report summary is from Euromonitor, which also sells a full version of this report.

- The U.S. has strongly been impacted by inflation, the impact was felt by restaurants with food inflation being the result of supply chain issues that started during Covid and intensified in the current geopolitical climate. The rise in prices has affected all aspects of food retail, including limited service restaurant. Restaurants started raising prices to catch up with the inflation, but slowed it down in order to retain their main demographic, low-income consumers. To deal with inflation and people eating at home some companies have turned to loyalty programs. With the pandemic pushing companies for tech advances and options of ordering online companies started gamifying their loyalty programs so that the consumers would need to make certain amount of purchases in order to get perks.

- The push for a greater online presence during the pandemic led to an improvement of online ordering options, and inclusion of delivery services. During this time, several major fast food chains reported a third of their sales coming from digital sales. With health risk subsiding people are going back to dining at the restaurants due to pent up demand during the pandemic. However, interest in ordering online persist. Restaurants that plan on opening new locations should look into locations and tech capabilities that would help retail food in direct to consumer and online manner.

- Labor shortages became another prominent issue for the industry, employees that were laid off would find other opportunities, and some would not go back into the industry due to lack of benefits, which was exposed during the health crisis faced by the country. While some restaurants work on increase of wages to entice employees, some chains started investing in automation. Automation would help improve efficiency, all the while providing consumers with services they need and having small labor costs.

Quick Service Restaurant Customer Demographics

Major customer segments for Fast Food Restaurants are reported by IBISWorld, which offers full version of the report for purchase here.

- Fast-Food Restaurant customers are segmented by income.

- Households earning greater than $100,000 have large amounts of disposable income and make up 56.8% of the market. However, they usually prefer more formal or full-service restaurants when eating out.

- Households earning between $50,000 but less than $99,999 comprise 23.3% of industry revenue. With fast food restaurants expanding their offerings with healthy options they became more popular with middle-income group.

- Households earning less than $50,000 represent the remaining 19.9% of the market. Smaller amounts of discretionary income limit their ability to eat away from home but fast food’s lower price point means they are usually the go-to restaurants when possible.

Fast Food Restaurant Business Startup Costs

According to a survey conducted by RestaurantOwner.com, the average restaurant startup costs are as follow:

- “Overall Costs: $375,500 – total, $3,586 – cost per seat, $113 – cost per sq. ft.

- Limited Service Costs: $225,500 – total, $4,510– cost per seat, $121 – cost per sq. ft.”

Of particular importance for quick service restaurant startup costs is to understand that many fast food restaurant businesses operate as a franchise. Franchise purchase fees can range between $20,000 – $50,000, but there are additional costs associated with starting a franchise. The overall costs, along with ongoing franchising fees, will have a large impact on your startup and ongoing operating costs. Contact your prospective franchisor or view their website for details. For more information on franchise businesses, see our Franchise guide.

Additional fast food restaurant startup costs information can be found at:

- Cost to Open a Restaurant from Toast

Costs of opening a restaurant vary depending on rent, furnishing of the restaurant, renovation needs and can range $95,000 to over $2 million. - Cost to Start a Restaurant from WebstaurantStore

Restaurant startup costs range from $180,000 to $800,000 depending on the location, concept, choice of buying vs leasing the space. - Drive-thru Service Tips from WebstaurantStore

Best practices for a operating a drive-thru service

Fast Food Restaurant Business Plans

The following are sample Fast Food Restaurant Business Plans for reference. For additional business plan samples, visit our Business Plans guide.

- Sample Restaurant Business Plan – Bplans

- Fast Food Restaurant Business Plan – Profitable Venture

- Quick Service Restaurant Business Plan – Profitable Venture

- Franchised Restaurant Business Plan – The Finance Resource

- How to write a comprehensive restaurant business plan – Grubhub

Fast Food Restaurant Business Associations

Trade associations often are excellent sources of information on an industry. Here are some relevant fast food restaurant industry associations:

- National Restaurant Association

- State Restaurant Associations (select your state from the drop down)

- Green Restaurant Association

- National Food Truck Association

- Council of State Restaurant Associations

Quick Service Restaurant Business Regulations

The section is intended to provide a general awareness of fast food restaurant regulations and agencies to consider when starting a fast food restaurant business. Check with your state and municipality for rules and regulations that may impact the business in your area. Most regulations are at the local and state level regarding food safety and general restaurant permits/licenses.

- State Retail and Food Service Codes and Regulations by State – U.S. Food & Drug Administration

- Menu Labeling Requirements – U.S. Food & Drug Administration calorie and nutrition labeling guidelines

- Food Code – U.S. Food & Drug Administration’s model for best practices for food safety

Quick Service Restaurant Business Publications

- QSR Magazine

- QSR Web

- Nation’s Restaurant News

- Fast Casual

- eRestaurant Business

- Modern Restaurant Management

- Restaurant Startup & Growth

- Food Network Magazine

Quick Service Restaurant Business Employment Trends

The National Restaurant Association Facts at a Glance reports on the size of the restaurant workforce:

- 15.5 million with 500,000 new jobs for foodservice employment forecasted for 2023.

- 90% of restaurants operate with fewer than 50 employees.

Of the millions of jobs in the restaurant industry, fast food employees make up 28% of the workforce.

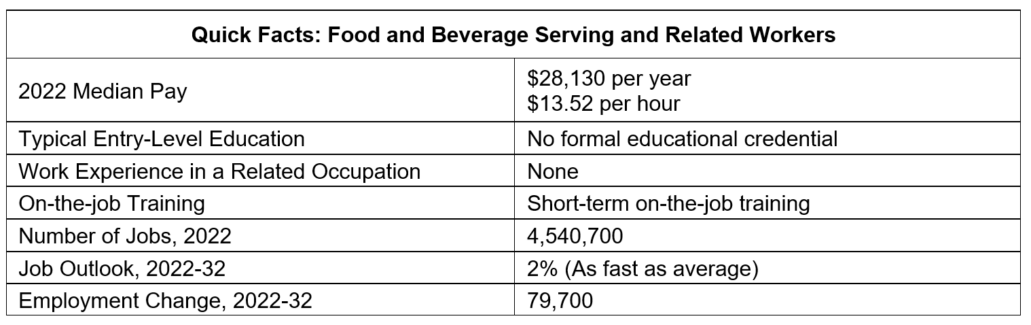

Labor costs are important factors for fast-food restaurant owners. Restaurants encompass a variety of jobs, the following are insights from the Bureau of Labor Statistics into the most customer-facing employees, food and beverage serving and related workers. Additional details are available for Fast Food and Counter Workers as well as Fast Food Cooks. A more specific breakdown of restaurants and other eating places is available from the Bureau of Labor Statistics.

- “Pay: The median hourly wage for food and beverage serving and related workers was $13.52 in May 2022.

- Work Environment: Food and beverage serving and related workers are employed in restaurants, schools, and other dining places. Work shifts often include early mornings, late evenings, weekends, and holidays. Part-time work is common..

- Job Outlook: Overall employment of food and beverage serving and related workers is projected to grow 2 percent from 2022 to 2032, about as fast as the average for all occupations.

About 1,026,200 openings for food and beverage serving and related workers are projected each year, on average, over the decade. Many of those openings are expected to result from the need to replace workers who transfer to different occupations or exit the labor force, such as to retire.”

Additional Resources

Already in business or thinking about starting your own small business? Check out our various small business resources:

- View more business reports here: Small Business Snapshots

- View small business help topics here: Small Business Information Center

- View industry-specific research here: Market Research Links

- View our small business cybersecurity resources here: Cybersecurity

- View our pandemic business resources here: COVID-19 Publications

Remember, you can also receive free professional business advice and free or low-cost business training from your local Small Business Development Center!

Photo by Sander Dalhuisen on Unsplash