Learn about the Daycare Industry and find more information on how to start a Daycare Business. Don’t forget you can receive free or low-cost training and free professional business advice from your local Small Business Development Center!

Get free Day Care business plan template on our Business Plans page.

Daycare Business Forecast

The daycare industry continues to recover from the pandemic as demand for childcare services has steadily increased heading into 2025. During the pandemic, the closures of daycare centers disrupted the economy and workforce making it difficult for employees to procure quality and affordable care for their families. A report from the U.S. Census Bureau and the U.S. Bureau of Labor Statistics showed that 5.5 million caregivers experience underemployment due to childcare limitations. Now that the workforce shifted its operations back to in-person, daycare centers are being met with a great demand. In 2025 and beyond, the outlook of the industry will rely heavily on the recovery of the workforce. Employee retention will be daycare’s main priority to respond to the growing demand for services. Assistance from federal and state governments is expected to increase to remedy labor shortages and increase wages for daycare workers. Most of the leg work will be left in the hands of the states to introduce new compensation scales and scholarship programs to foster employee interest in the industry. Federal help will come in the form of funding to help state efforts ensure lasting improvements for years to come.

The use of new technology in the daycare industry will grant new learning experiences for children, and lighten the load of administrative tasks on workers. Interactive learning has seen growth in popularity with parents as they seek out quality curriculum for early learners. Day cares are also moving past their usual assessments and establishing new learning skills to help children excel beyond the classroom. Social and emotional development is becoming an important matter that childcare centers are preparing to explore with early learners. The daycare industry is evolving to keep pace with parental workforce patterns, and technology advancements to create a more impactful learning environment for children.

Here are additional pandemic business resources specific to this industry:

- COVID-19 & Other Respiratory Viruses Resources – ChildCare.gov

- Emergency Child Care & Technical Assistance Center – Child Care Aware

- Franchise Reopening Blueprint, including Child Care/Education – International Franchise Association

- SBDCNet’s Small Business Pandemic Resources

Daycare Business Overview & Trends

NAICS Code: 624410, SIC Code: 8351

Day Cares are an important aspect of the economy because the presence of high-quality child care facilities a stable workforce. Day Cares support childhood early development, and establish a foundation for future learning. This child care industry summary is from First Research which also sells a full version of this report.

- “Companies in this industry provide supervision and educational programs for pre-school and school-age children. Major US companies include Bright Horizons, KinderCare Education, and Learning Care Group; major companies based outside the US include Elbkinder (Germany), G8 Education (Australia), and Partou (the Netherlands).

- Global demand for child care services and early childhood education is growing as a result of increases in the number of women in the workforce and the number of single-parent families, as well as reduced poverty and improved health services. The Organization for Economic Cooperation and Development (OECD) reports about 90% or more of children aged 3-5 in the majority of OECD countries are enrolled in early childhood education and care or primary school, with the OECD average enrolment rate 87%. Enrolment rates are high in France, Korea, Luxembourg, and the Netherlands.

- The US child care services industry includes about 80,000 establishments (single-location companies and units of multi-location companies) with combined annual revenue of about $40 billion.

- Competitive Landscape: Demand is driven primarily by growth in the youth population, and secondarily by employment and income. Recognition of the importance of early education is also driving demand for high-quality care. The profitability of individual child care facilities depends on good marketing, reputation, and efficient operations, as well as how saturated the local market is.”

Child Care Technology

Technology use is increasing in the child care industry. Here is information on new child care technology:

- Guiding Principles for Use of Technology with Early Learners – Guide on introducing and monitoring technology use with early learners.

- Technology and Young Children: Preschoolers and Kindergartners – List of technologies and how they are implemented.

- Technology and media – Exploring the Pros and Cons of using technology in child care.

- How technology can solve the childcare crisis – How AI can ease industry stressors.

For additional information on technology, visit our AI for Small Business Guide.

Daycare Customer Demographics

Major customer segments for day cares are reported on by IBISWorld, which offers a full version of the report for purchase here.

- The day care markets are segmented by private and government funding.

- The private payers segment makes up 67.1% of the market share and consists of families that bear the full financial responsibility for daycare services or receive help from scholarships and government aid. This segment has a substantial need for daycare services but has been impacted the most by economic stressors, resulting in less discretionary income and putting the daycare industry at risk.

- The government funding segment makes up 32.9% of the market and is comprised of both federal and local governments. Unused stimulus funds from the states have pivoted towards childcare services since 2022. The left-over funds have helped daycares address issues such as labor shortages and low wages. Private providers are at risk of losing government funds, caused by an increase in support for public early learning centers and daycares.

Additional information on child care can be found on variety of trade associations and publications, including:

- State by State Childcare Resources – ChildCareAware (select your state on the map for additional information)

- Child Care Data – U.S. Census Bureau

Daycare Business Startup Costs

According to cost breakdown reported by Profitable Venture, daycare related cost are as follows:

- “Starting a small scale but standard daycare facility business that can only accommodate a minimal number of children per–time in just one location in the United States of America will cost about one hundred thousand dollars to two hundred and fifty thousand dollars ($100,000 to $250,000).”

Additional day care startup cost information can be found at:

- Cost to open a day care center from Entrepreneur Magazine

- “Startup Costs: $10,000 – $50,000

Home Based: Can be operated from home.

Part Time: Can be operated part-time.”

- “Startup Costs: $10,000 – $50,000

Daycare Business Plans

The following are sample Day Care Business Plans for reference. For Additional business plan samples, visit our Business Plans Guide.

- Child Care Business Plan – Bplans

- Day Care Center Business Plan – The Finance Resource

- Day Care Business Plan Template – Profitable Venture

Daycare Business Associations

Trade associations often are excellent sources of information on an industry. Here are some relevant daycare industry associations:

- Child Care Aware of America

- National Association for Family Child Care

- National Child Care Association

- Child Care Services Association

- Association for Early Learning Leaders

- Childhood Education International

- Division for Early Childhood

- National Association for the Education of Young Children

- Zero to Three

- National Head Start Association

Daycare Business Regulations

The section is intended to provide a general awareness of daycare regulations and agencies to consider when starting a daycare. Check with your state and municipality for rules and regulations that may impact the business in your area. Daycare businesses tend to have much more regulation at the local level rather than at the national level.

- National Database of Child Care Licensing Regulations by State – U.S. Department of Health & Human Services Children & Families

- Child Care Licensing Tools and Resources – Office of Child Care: Child Care Technical Assistance Network

- Regulations – Child Care Aware

Daycare Business Publications & Resources

- Child Trends

- Tools, Publications and Resources

- Child Care Date Explorer & State Profiles

- Child Care Exchange

- Child Welfare Information Gateway

- Home Grown Child Care

Child Care Employment Trends

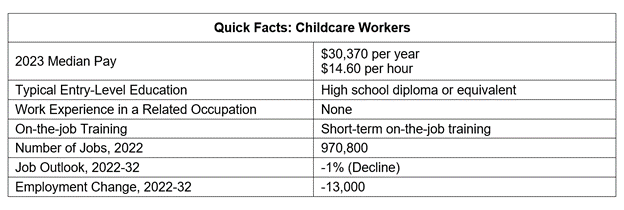

Understanding trends in your industry is important when opening a new daycare. The Following are insight from the Bureau of Labor Statistics Occupational Outlook Handbook into the main Child Care occupation, Childcare Workers. A more specific breakdown of other day care occupations is available from the Bureau of Labor Statistics.

- “Pay: The median hourly wage for childcare workers was $14.60 in May 2023. The median wage is the wage at which half the workers in an occupation earned more than that amount and half earned less. The lowest 10 percent earned less than $10.79, and the highest 10 percent earned more than $20.80.

- Work Environment: Family childcare workers care for children in their own homes. They may convert a portion of their living space into a dedicated space for the children. Nannies usually work in their employers’ homes.

Many states limit the number of children that each staff member is responsible for by regulating the ratio of staff to children. Ratios vary with the age of the children. Childcare workers are responsible for relatively few babies and toddlers. However, workers may be responsible for greater numbers of older children. - Job Outlook: Employment of childcare workers is projected to decline 1 percent from 2023 to 2033.

Despite declining employment, about 162,500 openings for childcare workers are projected each year, on average, over the decade. All of those openings are expected to result from the need to replace workers who transfer to other occupations or exit the labor force, such as to retire.”

Additional Resources

Already in business or thinking about starting your own small business? Check out our various small business resources:

- View more business reports here: Small Business Snapshots

- View small business help topics here: Small Business Information Center

- View industry-specific research here: Market Research Links

- View business plans samples here: Sample Business Plans

Remember, you can also receive free professional business advice and free or low-cost business training from your local Small Business Development Center!

Photo by Markus Spiske on Unsplash