Learn about the convenience store business industry and find information on how to start a convenience store or C-store. Don’t forget you can receive free or low-cost training and free professional business advice, from your local Small Business Development Center!

View our related business reports here: Food Industry Research and Beverage Industry Research

Get a free Convenience Store business plan template on our Business Plans page.

Convenience Store COVID-19 Resources

In response to the global COVID-19 pandemic, shelter-in-place orders and physical distancing measures have affected many businesses; here is a look at the impact to the Convenience Store industry. Convenience Stores were declared essential businesses when states began enforcing closures. However, operators were now subject to many new safety measures, both voluntary and not, including occupancy limits, requiring facial coverings to enter, sneeze guards, and wiping down surfaces multiple times during the day. Here are additional COVID-19 business resources specific to this industry:

- SBDCNet’s COVID-19 Small Business Resources

- SBDCNet’s COVID-19 Industry Resources

- NACS: Coronavirus Restrictions

- CSP: Coronavirus Safety Measure Survey

- C-Stores Pivot due to Coronavirus Outbreak

Convenience Store Industry Overview & Trends

NAICS Code: 445120 (no fuel), 447110 (with fuel); SIC Code: 5411

This market research regarding the Convenience Store and Truck Stops excerpt is from First Research, which also sells a full version of this report.

- “Companies in this industry operate retail locations that primarily sell fuel, groceries, cigarettes, and alcoholic beverages. Major US companies include 7-Eleven (the North American subsidiary of Seven Eleven Japan), Circle K (a division of Canada-based Couche-Tard), Casey’s General Stores, and Wawa. Economic growth, urbanization, and an increasing affinity for smaller store formats is driving growth in the global convenience store (c-store) sector. Worldwide c-store sales are expected to approach $5 trillion by 2022, according to a report from GlobalData. Japan, China, and emerging markets in Southeast Asia are among the fastest growing for c-stores.

- The US c-store and truck stop industry includes more than 155,000 stores, according to the National Association of Convenience Stores, with combined annual revenue of about $650 billion. The industry includes establishments that are gas station/c-store combinations, as well as c-stores that don’t sell fuel. Gas stations that don’t include c-stores are covered in a separate industry profile.

- Competitive Landscape: Consumer and commercial driving trends drive demand. The profitability of individual stores depends on competitive pricing, effective merchandising, and the ability to secure high-traffic locations. Large companies have advantages in purchasing and finance. Small companies can compete effectively by acquiring superior locations or offering specialized merchandise or services. The industry is fragmented: the top 50 US companies account for about 40% of industry sales. Single-store operators predominate, accounting for more than 60% of all convenience stores”

This Convenience Store market research report summary is from Euromonitor, which also sells a full version of this report.

- Alcohol Sales: Consumer awareness of the health risks and decreasing interest in tobacco and carbonated drinks has forced operators to refocus their sales strategies, having to deal with the decrease in revenue of two major product categories in their stores. A bright spot has appeared in alcohol sales. Many states have loosened various restrictions on these types of stores selling different kinds of alcohol. Combined with consumer desires for convenience in purchasing alcohol, sales have been bosted considerably.

- Foodservice Sales: For similar convenience reasons, many operators have found an additional bright spot in selling hot/prepared food and drinks such as coffee to customers. Corporate decisions and guidelines towards increasing the quality and value of in-store food selection have slowly been changing the negative stigma of “gas station food.” Many locations are having very successful in-store foodservice rebranding.

Convenience Store Business Customer Demographics

IBISWorld reports on the major market segments for Convenience Stores in the US. The full version of the report is available for purchase.

- Consumers below age 25 (10.6%): These consumers are the smallest share of the market mainly due to a lack of expendable income and/or access to transportation. However, the convenience of these stores and the specific product selection (candy/snacks/soda) compared to larger big box or grocery stores appeals to them and can make them frequent customers.

- Consumers between ages 25 and 44 (37.8%): Many of these consumers are young professionals or young families who value their time and convenience. With less brand loyalty than older groups, convenience stores are very attractive to this age group. The growth of in-store prepared food also appeals to them.

- Consumers aged between 45 and 64 (38.1%): With a larger amount of disposable income and a limited amount of time, this age bracket is a very large segment of the market. However, older customers in this bracket begin to prefer buying all of their needs at larger stores rather than smaller convenience stores.

- Consumers aged 65 and older (13.5%): As customers become retired, the time saving appeal of convenience stores becomes less of a selling point for them. In it’s place, they tend to value larger box stores or supermarkets that can also sell them products in one trip that convenience stores cannot, such as filling their prescriptions, home goods, and a broader selection of groceries. However, this segment does provide a large amount of smokers for operators to sell cigarettes to.

C-Store Business Startup Costs

According to Entrepreneur: Business Idea Center: Convenience Stores:

- “Startup Costs: $10,000 – $50,000

- Franchises Available? Yes

- Online Operation? Yes

- In spite of the rising popularity of internet shopping combined with home delivery of grocery and convenience items, starting and operating a ‘mini convenience store’ is still a good business venture to activate that has the potential to generate respectable profits. The name suggests it all. In order to succeed in this segment of the highly competitive retail industry, the store must be convenient. This means an easily accessible and highly visible business location, well-stocked with the most popular convenience products, and fast and friendly service.”

According to ProfitableVenture: Starting a Convenience Store Business:

- “As for technical requirements, you would need a number of equipment to manage your business especially for handling payments, inventory and preventing theft. Some of the equipment you might need include: RFID Scanners, Anti-theft devices, CCTV installations, POS Software and gadgets, Credit card terminals, Touch screen monitors, Customer pole displays, Carts, Sponge matting for fruits and vegetables, Plastic bags, Measuring Scales, Shelving, Freezers and refrigerators, Stationery, Office desk and chairs, Computers, Delivery vans

- You may not have to buy all of these items if you are starting really small or operating a limited selection convenience store but as your business continues to grow, you may need all of these and more.You can purchase the larger equipment from fairly-used dealers or on hire-purchase while some of the gadget suppliers can allow you to spread the costs over a few months.”

According to Chron: How to Stock a Convenience Store:

- “While the items in a convenience store don’t generally cost too much individually, costs do add up. Expect to pay at least $20,000 to stock even a small store.

- The number of products you choose to sell in your convenience store will influence the cost to stock the store. Very small convenience stores may stock as few as 500 stock-keeping units, or SKUs, according to the business appraisal firm JSO Valuation Group. JSO reports that a typical convenience store, though, carries nearly 2,500 different products, and larger convenience stores, such as those at major truck stops, may carry even more.”

How to Open a Convenience Store

Starting a Convenience Store Checklist

Convenience Store Business Plans

Convenience Store Publications

- Convenience Store Decisions Magazine Online

- CSP Daily News

- Convenience Store News Online

- Convenience Store News for the Small Operator

- 27 Industry Marketing Tips from the Pros

- Gas and Convenience Store Marketing and Promotion Ideas

Convenience Store Associations

Trade associations often are excellent sources of information on an industry. Here are some relevant convenience store industry associations:

- National Association of Convenience Stores

- American Petroleum and Convenience Store Association

- State Associations for Convenience Stores

- National Association of Truck Stop Operators

Convenience Store Business Employment Trends

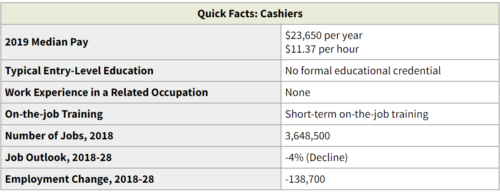

Understanding trends in your industry is important when running a convenience store, with your most common type of employee most likely being a cashier. Here is a labor market summary from the Bureau of Labor Statistics focused on Cashiers.

“Work Environment

Cashiers held about 3.6 million jobs in 2018. The largest employers of cashiers were as follows:

Food and beverage stores – 27%

General merchandise stores – 21%

Gasoline stations – 17%

Restaurants and other eating places – 9%

Pharmacies and drug stores – 5%

The work is often repetitive, and cashiers spend most of their time standing behind counters or checkout stands. Dealing with dissatisfied customers can be stressful.

Job Outlook

Employment of cashiers is projected to decline 4 percent from 2018 to 2028.

Although retail sales are expected to increase over the next decade, employment of cashiers is expected to decline because of advances in technology, such as the use of self-service checkout stands in retail stores and increasing online sales.

Pay

The median hourly wage for cashiers was $11.37 in May 2019. The median wage is the wage at which half the workers in an occupation earned more than that amount and half earned less. The lowest 10 percent earned less than $8.73, and the highest 10 percent earned more than $15.04.”

Additional Resources

Already in business or thinking about starting your own small business? Check out our various small business resources:

- View more business reports here: Small Business Snapshots

- View small business help topics here: Small Business Information Center

- View industry-specific research here: Market Research Links

- View business plans samples here: Sample Business Plans

Remember, you can also receive free professional business advice and free or low-cost business training from your local Small Business Development Center!

Photo by Kentaro Toma on Unsplash