Learn about trends in the Auto Repair industry and find more information on how to start an Auto Repair Business. Don’t forget you can receive free or low-cost training and free professional business advice, from your local Small Business Development Center!

View our related business reports here: Auto Repair Business and Automotive Industry Research.

Get a free Auto Repair business plan template on our Business Plans page.

Auto Repair Business COVID-19 Resources

In response to the global COVID-19 pandemic, shelter-in-place orders and physical distancing measures affected many businesses; here is a look at the impact to the auto repair business industry. Supply chains for auto parts used in repairs and maintenance have been disrupted, especially those involving parts manufactured overseas in China. While auto repair shops are deemed essential services and have remained open with modifications in daily operations, demand for these services has fallen as consumers have moved to maintaining their cars themselves during the pandemic. Here are additional COVID-19 business resources specific to this industry:

- SBDCNet’s COVID-19 Small Business Resources

- SBDCNet’s COVID-19 Industry Resources

- Coronavirus Business Resources – Auto Care Association

- Franchise Reopening Blueprint, including Automotive – International Franchise Association

- FenderBender Magazine COVID-19 Articles – Fender Bender Magazine

Auto Repair Business Industry Overview & Trends

NAICS Code: 811111; SIC Code: 7538

This market research regarding the Automotive Repair and Maintenance Services Industry excerpt is from First Research which also sells a full version of this report.

“Companies in this industry provide repair and maintenance services for passenger cars and light trucks. Major US companies include Firestone Complete Auto Care (a unit of Bridgestone), Jiffy Lube, Meineke, Midas, Monro Muffler Brake, and Safelite Group.

The global automotive repair and maintenance services industry is forecast to grow at a double-digit compound annual rate between 2015 and 2025, according to Future Market Insights, driven by increasing vehicle production and growing demand from emerging markets, notably China and India.

The US automotive repair and maintenance services industry includes about 160,000 establishments (single-location companies and units of multi-location companies) with combined annual revenue of about $115 billion.

Competitive Landscape: Demand depends on miles driven and the number of cars on the road. The increased complexity of vehicles, which makes it more difficult for vehicle owners to perform do-it-yourself repairs, is also driving demand. The profitability of individual companies depends on convenient location and good marketing. Large companies can maximize use of expensive diagnostic equipment and have advantages in purchasing, distribution, and marketing. Small companies can compete effectively by providing superior customer service or offering specialized services. The US industry is highly fragmented: the 50 largest companies generate less than 10% of revenue.

Competition includes other venues that provide automotive services, including some gas stations, car dealerships, and branches of mass merchandisers, like Sears and Kmart.”

Auto Repair Business Customer Demographics

IBISWorld reports on the major market segments for Auto Mechanics in the US. The full version of the report is available for purchase.

- The Auto Mechanics industry in the United States generates approximately $70.0 billion dollars in revenue annually.

- Auto Mechanic customers are segmented into four categories: individuals/households (64.5%), businesses (29.7%), government (4.4%), and nonprofit organizations (1.4%).

- Household and individual consumers can be further segmented by age, including consumers under the age of 45 (24.1%), consumers between the ages of 45-64 (26.1%), and consumers 65 and above (14.3%).

Auto Repair Business Startup Costs

- How to Start a Auto Repair Shop: Financial Overview

“The cost to open a car repair shop will largely depend on the shop’s size and the amount of money that you invest into specialty supplies and equipment. A one-bay shop with one vehicle lift stocked with basic equipment will cost about $50,000 to start. Larger shops with more extensive equipment and multiple lifts can cost as much as $75,000 or more to open.” - Profits and Costs of Auto Repair Shops

“Startup Costs and Overhead

The overhead prices will, of course, vary from shop to shop, but that and supplies can generally cost an auto shop between $10,000 and $20,000 per month. While the costs to start an auto shop will vary, according to this article, the general costs include:- Business License: $50 to $100

- ASE Certifications: $36 registration fee, one time, plus $39 per certification, except L1, L2, and L3 certs which are $78

- Insurance: $4,000 per year

- Mechanic’s Hydraulic Lift: $3,700

- Diagnostic Machine: $5,000 to $10,000

- Shop Rental Fees: $1,500 to $15,000 per month

- Mechanic’s Toolset with Specialty Tools: $15,000

- Total Cost: $50,000+“

- How To Start & Finance An Auto Body Shop Business

Auto Repair Business Plans

- Auto Repair Service Business Plan

- Automotive Repair Shop Business Plan

- Mobile Auto Mechanic Business Plan Template

Auto Repair Business Publications & Resources

- Auto Body Repair News Magazine

- Auto Inc.

- Auto Service Professional

- Body Shop Business

- CollisionWeek

- FenderBender Online Magazine

- Professional Tool & Equipment News Magazine

- Shop Owner

Auto Repair Business Associations

Trade associations often are excellent sources of information on an industry. Here are some relevant industry associations:

- Automotive Service Association

- Auto Care Association

- National Automobile Dealers Association

- International Automotive Technicians Network

Auto Repair Business Employment Trends

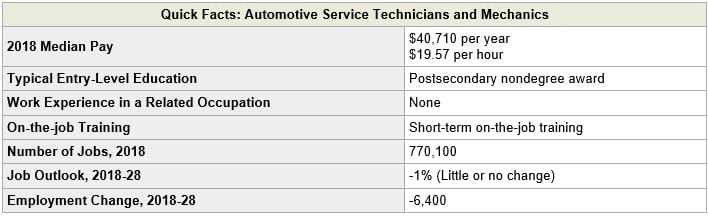

Understanding trends in your industry is important when running an auto repair business. Here is a labor market summary from the Bureau of Labor Statistics focused on Automotive Service Technicians and Mechanics Market Conditions.

“Work Environment

Most automotive service technicians and mechanics work in well-ventilated and well-lit repair shops. Although technicians often identify and fix automotive problems with computers, they commonly work with greasy parts and tools, sometimes in uncomfortable positions

Job Outlook

Employment of automotive service technicians and mechanics is projected to show little or no change from 2018 to 2028. Job opportunities for qualified jobseekers should be very good.”

Additional Resources

Already in business or thinking about starting your own small business? Check out our various small business resources:

- View more business reports here: Small Business Snapshots

- View small business help topics here: Small Business Information Center

- View industry-specific research here: Market Research Links

- View business plans samples here: Sample Business Plans

Remember, you can also receive free professional business advice and free or low-cost business training from your local Small Business Development Center!

Photos

Photo by Tim Mossholder on Unsplash