Learn about the Cleaning Services industry and find more information on how to start a Cleaning Services business or janitorial services. Don’t forget you can receive free or low-cost training and free professional business advice, from your local Small Business Development Center!

Get a free Cleaning Services business plan template on our Business Plans page.

Cleaning Services Business Forecast

The cleaning industry has seen a strong recovery from the pandemic as demand for cleaning services increased for homes and office buildings. Much of this industry’s revenue relies heavily on the strength of the economy. For residential cleaning services, estimates released by the Bureau of Economic Analysis, report that personal income expenditure increased by $43.9 billion and spending for services has increased by $121.0 billion. The growth in spending projects a positive outlook for cleaning services since households will have more disposable income to spend on personal services.

In 2024 and the years ahead, cleaning services will continue to see consistent growth as businesses make this service a priority. Organizations created new standards to ensure that commercial and residential spaces are being cleaned properly. Namely, the Centers for Disease Control and Prevention (CDC), and the Environmental Protection Agency (EPA) updated their guidelines for cleaning and disinfecting. Now that businesses are recalling their workforce, cleaning services are seeing a higher volume of demand.

Residential demand will make a smaller contribution to this industry’s growth beyond 2024. The demand from homeowners will parallel mortgage rates as that affects the amount of spending on home goods and services. Homeowners’ need for cleaning services may rely primarily on specialized services like carpet and floor cleaning.

- SBDCNet Small Business Pandemic Resources

- ISSA Cleaning and Disinfecting for the Coronavirus

- American Cleaning Institute Coronavirus Resources

- BOMA International’s Coronavirus Resource Center

- International Franchise Association Reopening Blueprint, including Cleaning Services

Cleaning Services Business Overview & Trends

NAICS Code: 561720; SIC Code: 7349

Cleaning Services are an important contributor to the maintenance of residential and commercial buildings. This janitorial & carpet cleaning summary is from First Research which also sells a full version of this report.

- “Companies in this industry clean building interiors, windows, carpets, and upholstery. Major US companies include divisions of companies such as ABM Industries, Coverall North America, Jani-King, Stanley Steamer, and Terminix; major companies based outside the US include divisions of Aeon Delight (Japan), Consorzio Nazionale Servizi (Italy), ISS World Services (Denmark), Mitie Group (UK), and Wisag (Germany).

- The global cleaning services market is expected to reach about $90 billion by 2027, growing at a compound annual growth rate (CAGR) of about 7%, according to Beroe Inc. North America, Europe, and Australia have the high market maturity regions.

- The US janitorial services and carpet cleaning industry consists of about 60,000 janitorial establishments (single-location companies and units of multi-location companies) with combined annual revenue of about $50 billion and about 7,500 carpet and upholstery cleaning establishments with combined annual revenue of about $3 billion.

- Commercial real estate occupancy drives demand for cleaning services. The profitability of individual companies depends on good marketing. Large companies have an advantage in serving customers with multiple locations. Small companies can compete effectively in local markets, especially for small business and residential customers.

- The US janitorial services industry and the US carpet cleaning industry are fragmented: the 50 largest companies of both industries generate about 30% of revenue and 25%, respectively.”

Cleaning Services Technology

Technology is a developing segment of the cleaning services industry. Here is information on new cleaning industry technology:

- Considering a Computerized Maintenance Management System? – Exploring the use of CMMS in the cleaning industry.

- CleanFax – How companies across America are using technology in their business.

For additional information on technology, visit our AI for Small Business Guide.

Cleaning Services Business Customer Demographics

Major customer segments for janitorial services are reported by IBISWorld, which offers full versions of the reports for purchase here.

- The janitorial services market is segmented by commercial, residential, and damage restoration.

- Commercial cleaning segment makes up 73.3% of the market and deals specifically in the cleaning of hospitals, retail stores, offices and other commercial buildings. Demand for commercial cleaning services is dependent on company policies, seasonal employment, and current economic characteristics.

- Residential cleaning services segment makes up 14.3% of the market, and pertains to the interior cleaning of homes. Demand for this segment is heavily influenced by the cost and the amount of homes being built. Newer expensive homes usually require more cleaning and maintenance.

- Demand from the government and non-profits makes up the remaining 12.4%. The cleaning of federal, state, and local government buildings typically is sourced as part of a contracting process. For nonprofits, their operating expenditures may be constrained by their funding streams.

- Across all segments, healthy economic conditions are typically a good indicator of spending in these services.

Additional information on cleaning services can be found on variety of trade associations and publications, including:

- Top Trends and Challenges for Commercial Cleaning Providers – Facilities Management Advisor

- Cleaning trends we have fallen out of love with in 2023 – Home & Gardens

- The State of Today’s Cleaning Industry – ISSA

Cleaning Services Business Startup Costs

According to cost breakdown reported by Profitable Venture, cleaning services related cost are as follows:

- Estimate startup costs of $750,000 to set up a medium scale but standard cleaning company.

- Estimate startup costs between $5,000 and $15,000 for a smaller cleaning business.

Additional cleaning startup cost information can be found at:

- Cost breakdown reported by Entrepreneur Magazine, for commercial and residential cleaning services are as follows:

- “Startup Costs: Under $2,000

- Part Time: Can be operated part-time.

- Franchises Available? Yes

- Online Operation? No”

- Cost to start a cleaning business from ZenBusiness

- On average, you can expect to spend anywhere from $2,000 to $10,000 in initial startup costs.

- Cost to start a cleaning business from The Janitorial Store

- “Reports show that the average cleaning or janitorial service will spend $3500 on startup costs.”

- Cost of equipment for floor cleaning business from Profitable Venture

- “Note that your cleaning equipment might include a commercial vacuum costing $200-$350, along with a trash pick-up container, mop bucket and press,”

Janitorial Services Business Plans

The following are sample Cleaning Service Business Plans for reference. For additional business plan samples, visit our Business Plans guide.

- Janitorial Services Business Plan – Bplans

- Cleaning Service Business Plan – Bplans

- Cleaning Service Business Plan – Profitable Venture

- Maid and Cleaning Business Plan – The Finance Resource

- Window Cleaning Service Business Plan – The Finance Resource

- Carpet Cleaner Business Plan – The Finance Resource

Cleaning Services Business Associations

Trade associations often are excellent sources of information on an industry. Here are some relevant cleaning services industry associations:

- ISSA – The Worldwide Cleaning Industry Association

- ISSA Residential

- American House Cleaners Association

- Building Service Contractors Association

- Building Owners and Managers Association International

- Cleaning Equipment Trade Association

- National Cleaners Association

- International Window Cleaning Association

- Restoration Industry Association

- National Air Duct Cleaners Association

- The Cleaning Institute

Janitorial Services Business Regulations

The section is intended to provide a general awareness of regulations and agencies providing oversight to the cleaning industry to consider when starting your business. Check with your state and municipality for rules and regulations that may impact the business in your area.

- Cleaning Industry Standards – Occupational Safety and Health Administration

- Protecting Workers Who Use Cleaning Chemicals – Occupational Safety and Health Administration

- Determining If a Cleaning Product Is a Pesticide Under FIFRA – U.S. Environmental Protection Agency

- Standards & Certifications – ISSA

Cleaning Services Business Publications

- Building Services Management

- Cleaning Business Today

- CleanLink

- Tomorrow’s Cleaning

- Cleaning and Maintenance Management

- Facilities Maintenance Decisions

- ZenMaid Magazine

Janitorial Services Business Employment Trends

Labors costs are typically the largest expense for a janitorial service. A critical component as an agency grows is hiring qualified workers. A breakdown of wages for Janitorial and Building Cleaners businesses in the U.S. is available from the BLS Occupational Employment and Wage Statistics, see 37-2011 for commercial cleaning occupations and 37-2012 for residential cleaning occupations.

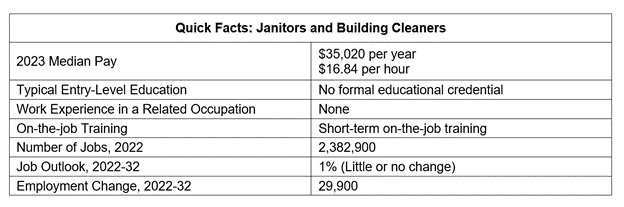

The following are insights from the U.S. Bureau of Labor Statistics Occupational Outlook Handbook focused on janitors and building cleaners.

- “Pay: The median hourly wage for janitors and building cleaners was $16.84 in May 2023. The median wage is the wage at which half the workers in an occupation earned more than that amount and half earned less. The lowest 10 percent earned less than $12.39, and the highest 10 percent earned more than $23.18.

- Work Environment: Janitors and building cleaners usually work indoors, but they may work outdoors on tasks such as sweeping walkways, mowing lawns, and shoveling snow. They spend most of the day walking, standing, or bending while cleaning. They often move or lift heavy supplies and equipment. As a result, the work may be strenuous on the back, arms, and legs. Some tasks, such as cleaning restrooms and trash areas, are dirty or unpleasant.

- Job Outlook: Employment of janitors and building cleaners is projected to show little or no change from 2022 to 2032.

Despite limited employment growth, about 336,700 openings for janitors and building cleaners are projected each year, on average, over the decade. Most of those openings are expected to result from the need to replace workers who transfer to different occupations or exit the labor force, such as to retire.

The continued need for clean and healthy spaces will support demand for the services that janitors and building cleaners provide. However, this demand will be offset by the increase in remote and hybrid work environments, which will reduce the number of physical office spaces that require regular cleanings and maintenance. In addition, the continued use of hi-tech cleaning methods may limit employment growth for these workers.”

Additional Small Business Resources

Already in business or thinking about starting your own small business? Check out our various small business resources:

- View more business reports here: Small Business Snapshots

- View small business help topics here: Small Business Information Center

- View industry-specific research here: Market Research Links

- View business plans samples here: Sample Business Plans

Remember, you can also receive free professional business advice and free or low-cost business training from your local Small Business Development Center!