Learn about trends in the Beauty Salon, Hair Salon, and Nail Salon industry and find more info about how to open your own Beauty Salon business. Don’t forget you can receive free or low-cost training and free professional business advice from your local Small Business Development Center!

Get free Beauty Salon, Hair Salon, Nail Salon business plans templates on our Business Plans page.

Beauty Salon Business Forecast

The beauty salon industry is beginning to reflect early signs of consumer restraint. Clients are showing heightened financial anxiety as concerns increase regarding layoffs and weakening retirement savings, leading many customers to pull back on discretionary salon services. These shifts reflect the overall slowdown in household spending, with Morgan Stanley projecting U.S. consumer spending growth to ease in the years ahead, a trend expected to be most pronounced among lower to middle income consumers. Meanwhile, new tax provisions for beauty workers, such as the federal tip deduction, offer some relief yet remain too limited to offset rising operating costs or counter slowing demand. Ultimately, discretionary salon visits are becoming less frequent and more selective, shaped increasingly by wider economic pressures.

Beauty consumption continues to evolve as consumers become more discerning about what feels valuable and effective. McKinsey & Company notes that younger generations are reshaping beauty expectations around wellness and authenticity, thereby influencing how salons present their services. At the same time, recent Bank of America data shows self‑care services remain comparatively resilient. Spending on salons, barbershops, and gyms has risen 1.6% year over year even as retail beauty purchases declined 1.4% during the same periods. Beauty services still anchor this growth, though at a slower pace. Meanwhile, rising costs tied to tariffs continue to increase inflation pressures, particularly as businesses face higher prices for imported goods and begin passing more of these costs on to consumers. As a result, the industry now faces a challenge to show stronger value and distinction as changing market dynamics influence how consumers evaluate beauty services.

Here are additional business resources specific to this industry:

- Salon Today – Business Resources

- The Hair Society – Tips & Tricks

- Pro Beauty Association – Support for Beauty Industry Professionals

Beauty Salon Industry Overview & Trends

NAICS Code: 812112; SIC Code: 7231

This hair care services industry summary is from First Research which also sells a full version of this report.

- “Companies in this industry operate hair salons and barber shops. Major companies include Regis Salons and Sport Clips (both based in the US), as well as Klier (Germany) and Stefan Hair Fashions (Australia).

- Key sources of growth for the global hair care industry include expanding middle classes in developing nations. Shifting cultural norms also drive demand.

- The US hair care services industry includes about 84,000 establishments (almost 80,000 beauty salons; over 5,000 barber shops) with combined annual revenue of about $25 billion.

- Competitive Landscape: Demand is driven by demographics, population growth, and personal income. The profitability of individual companies depends on effective marketing and maintaining repeat business. Large companies enjoy economies of scale in purchasing and marketing. Small companies can compete successfully by offering superior service or securing favorable locations. The barber shop segment of the industry is fragmented: the 50 largest operators generate less than 30% of US industry revenue; while the beauty salon segment is highly fragmented: the 50 largest beauty salon operators generate about 15% of revenue.

- Products, Operations & Technology: Major sources of revenue come from haircut and styling services, accounting for about 95%. Hair coloring and tinting account for about 2%, and retail sales of personal hygiene supplies.”

These hair care business market insights are derived from Euromonitor which sells a full version of their report.

- Hair care maintained steady growth, even as other beauty and personal care categories slowed down. Major brands and indie disruptors continued competing through premium products and innovative launches to draw consumer interest.

- E-commerce remains a major distribution driver. However, more brands are expanding into physical retail to strengthen visibility and accessibility.

- Salon professional products are set to outperform the overall category as consumers seek higher-quality solutions backed by experts. Non-hair care brands from adjacent beauty segments are also entering the space and intensifying competition.

- Developments in scalp care are expected to lead innovation, with portfolios centered around scalp health continuing to shape new products and consumer interest.

Beauty Salon Technology

Technology is becoming a crucial aspect of how modern salons operate and interact with clients. Beauty salon technology, or “Beauty tech,” has been on the rise, expanding beyond traditional services as new clinically backed innovations and smart devices are changing how the industry approaches beauty. This shift is rooted in broader consumer behavior changes, including the influence of social media and the demand for more personalized routines. The industry also points to emerging technologies such as AR-based guidance and sustainable solutions to optimize the client beauty experience and streamline operations. Here is information on new technology additions to the salon industry:

- How beauty players can scale gen AI – using gen-AI to expand beauty capabilities.

- What’s Next for Beauty – tech innovations influencing beauty customization.

- The 7 Essential Tech Tools for Salons & Solopreneurs – digital tools useful for salon businesses.

- How Technology Is Driving Growth and Inclusion In Beauty And Wellness – how tech platforms and data are helping beauty and wellness businesses grow.

- The Salon of Tomorrow: How Technology Plays a Part in Your Future – automation and software supporting salon operations.

For additional information on technology, visit our AI for Small Business Guide.

Hair Salon & Nail Salon Customer Demographics

Consumer preferences are widely transforming the beauty salon industry. The latest Boulevard survey reveals that Gen Z and Millennial clients are changing how salons and spas are evaluated. In fact, 55% of Gen Z and 47% of Millennials rate a social media presence as the most important factor when deciding where to book. As these demographic’s tap into greater spending power, understanding and delivering on their expectations could set your salon apart.

Major customer segments for Hair and Nail Salons are reported by IBISWorld, which offers full versions of their reports for purchase here.

- The nail and hair salon markets are segmented by age groups, with older consumers representing the highest spending segment.

- Consumers aged 55 account for 30.0% of the market share and sped the most on hair care services. Their reliance on routine appointments, due to limited mobility, increases the demand for more accessible service options.

- Middle-aged consumers aged 45 to 54 typically have higher disposable income and make up 21.9% of the market. Their spending tends to focus on high-quality service such as hair coloring and other visual enhancing treatments.

- Consumers aged 35 to 44 hold 19.1% of the market, driven by strong demand for high-value services such as straightening and perms. Those aged 25 to 34 represent 16.0% and frequently seek regular haircuts and routine coloring that fit their professional and social lifestyles.

- Consumer under the age 25 account for 12.1% of the market, due to limited discretionary spending. This group typically chooses basic, lower-cost services. Budget-friendly packages and loyalty incentives tend to resonate most with this group.

Additional information on the hair and nail salons industry can be found from a variety of trade associations and publications, including:

- State of Beauty: Solving a shifting growth puzzle – McKinsey & Company

- How Tomorrow’s Beauty Consumer Will Shop – Business of Fashion

- US Teens Are Shaking Up the World of Beauty – Boston Consulting Group

- 7 Ways Convenience Culture is Reshaping Beauty, Grooming, & Wellness – American Salon

Beauty Salon Business Startup Costs

Opening a beauty salon requires a clear understanding of the startup costs so you can create a solid financial plan. Whether you’re purchasing an existing salon or searching for the right location for your own, there are important expenses to consider.

According to research conducted by Sage.com, beauty salon startup costs are as follow:

- “Physical location – If you plan on purchasing a space expect to set aside $40,000 to $250,000 to purchase an existing salon (dependent on location, size, and condition of the property and equipment). Bump that up to $100,000 to $500,000 on average to build a salon from the ground up.

- Salon equipment – equipment costs will vary depending on type of salon. A full hair salon expense list is estimated to total about $27,000. For any type of salon, you’ll need styling stations with chairs, which can range from $200 to upwards of $1,000.

- Initial supplies – Costs will vary by brand but make sure you consider sanitizers, perm rods, hair capes, towels, shampoos, conditioners, specialty polishes and the like. Supplies add up quickly—stocking everything you need can cost up to $20,000 to start.”

Additional beauty salon startup cost information can be found at:

- Cost to become a Hairstylist from Entrepreneur Magazine:

- “Startup Costs: Under $2,000

- Home Based: Can be operated from home.

- Part Time: Can be operated part-time.

- Franchises Available? No.

- Online Operation? No”

- Costs to open a nail salon from Entrepreneur Magazine:

- “Startup Costs: $2,000 – $10,000

- Home Based: Can be operated from home.

- Part Time: Can be operated part-time.

- Franchises Available? Yes

- Online Operation? Yes”

- Cost to consider from Cardconnect:

- Listing of resources and equipment.

Beauty Salon Business Plans

The following are sample Beauty Salon Business Plans for reference. For additional business plan samples, visit our Business Plans Guide.

- Hair And Beauty Salon Business Plan – Bplans

- Hair and Nail Salon Business Plan – The Finance Resource

- Beauty Salon Business Plan – Profitable Venture

- Nail Salon Business Plan – Profitable Venture

Beauty Salon Business Associations

Trade associations often are excellent sources of information on an industry. Here are some relevant industry associations for beauty salons:

- Professional Beauty Association

- Salon Spa Professional Association

- Independent Beauty Association

- Associated Skin Care Professionals

- Associated Nail Professionals

- The Day Spa Association

- American Association of Cosmetology Schools

Beauty Salon Business Regulations

This section is intended to provide a general awareness of beauty salon regulations and agencies to consider when starting a beauty salon business. Check with your state and municipality for rules and regulations that may impact the businesses in your area.

- Hair Salons: Facts about Formaldehyde in Hair Products – Occupational Safety and Health Administration

- Salon Professionals: Fact Sheet – U.S. Food & Drug Administration

- Workers Protection Guide – United States Environmental Protection Agency

- Nail Salon Workers Wage and Hour Rights – United States Department of Labor

Beauty Salon Business Publications & Resources

For resources to help market your beauty salon start up, visit our Digital Marketing Guide, Social Media Marketing Guide, and our Website Design Guide.

Beauty Salon Business Employment Trends

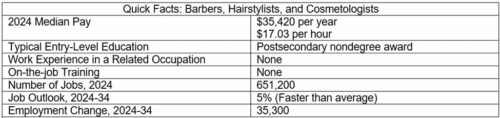

Understanding trends in your industry is important when opening a new beauty salon. Salons employ a variety of hair and beauty specialist. The following are insights from the Bureau of Labor Statistics Occupational Outlook Handbook into one of the main occupations, barber, hairstylist, and cosmetologist. A more specific breakdown of other beauty salon occupations is available from the Bureau of Labor Statistics.

- “The median hourly wage for barbers was $18.73 in May 2024. The median wage is the wage at which half the workers in an occupation earned more than that amount, and half earned less. The lowest 10 percent earned less than $13.35, and the highest 10 percent earned more than $37.71. The median hourly wage for hairdressers, hairstylists, and cosmetologists was $16.95 in May 2024. The lowest 10 percent earned less than $11.82, and the highest 10 percent earned more than $33.76.

- Work Environment: Barbers, hairstylists, and cosmetologists work mostly in barbershops or salons, although some work in spas, hotels, or resorts. Some lease booth space from a salon owner. Others manage salons or open their own shop after several years of gaining experience. Barbers, hairstylists, and cosmetologists usually work in pleasant surroundings with good lighting. Physical stamina is important because they are on their feet for most of their shift. Prolonged exposure to some chemicals may cause skin irritation, so they often wear protective clothing, such as disposable gloves or aprons.

- Job Outlook: Overall employment of barbers, hairstylists, and cosmetologists is projected to grow 5 percent from 2024 to 2034, faster than the average for all occupations. About 84,200 openings for barbers, hairstylists, and cosmetologists are projected each year, on average, over the decade. Many of those openings are expected to result from the need to replace workers who transfer to different occupations or exit the labor force, such as to retire.”

Additional Resources

Already in business or thinking about starting your own small business? Check out our various small business resources:

- View more business reports here: Small Business Snapshots

- View small business help topics here: Small Business Information Center

- View industry-specific research here: Market Research Links

- View business plans samples here: Sample Business Plans

Remember, you can also receive free professional business advice and free or low-cost business training from your local Small Business Development Center!

Photo by Adam Winger on Unsplash